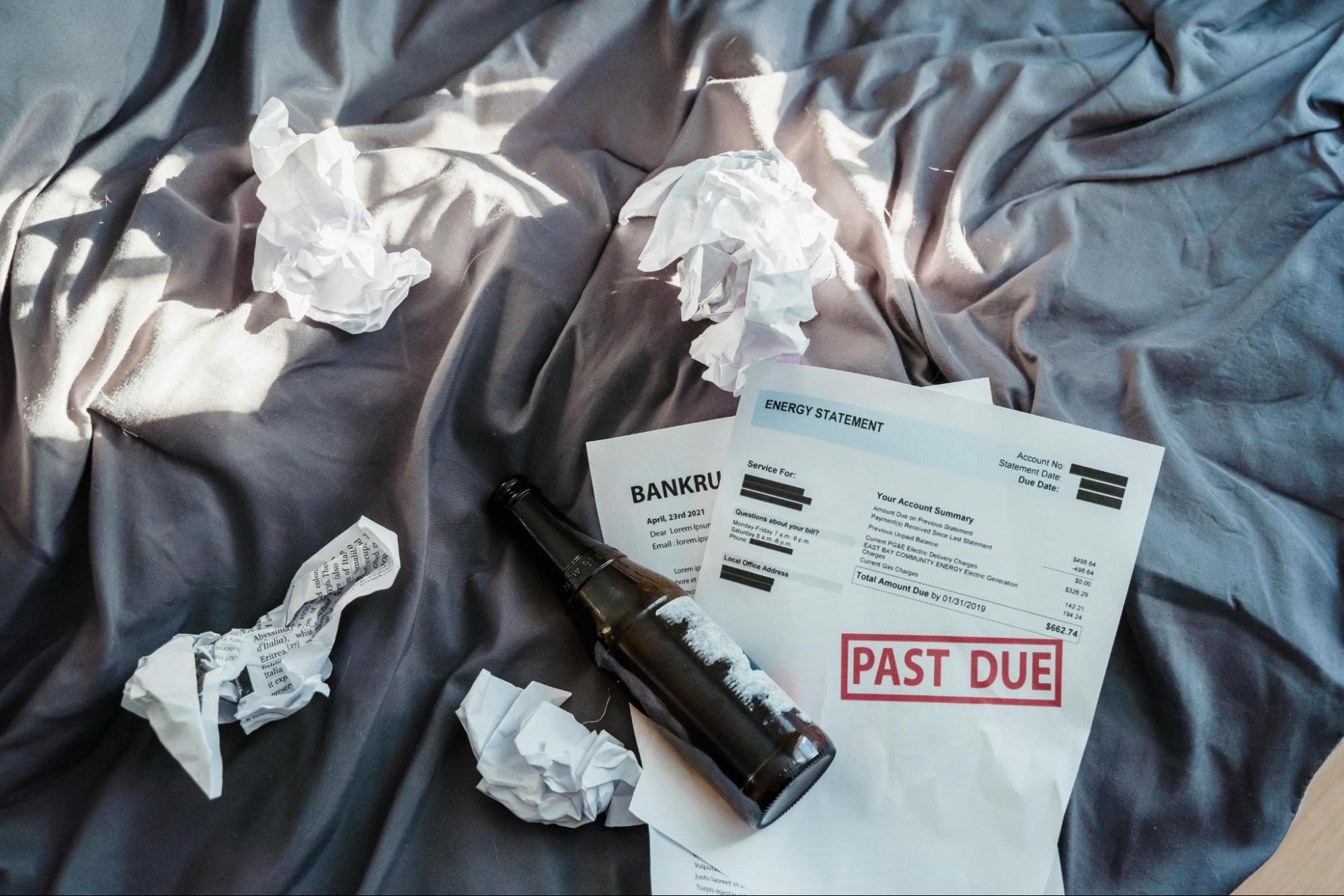

No one buys property expecting to have money problems in the future. In fact, buying a property signals they’re expecting the complete opposite. Sadly, this isn’t always the case, and recent reports suggest that around 40% of homeowners don’t have an emergency savings fund, and another 40% couldn’t cover a $1,000 emergency with cash or savings.

And how money is tight, what are your options? You can’t keep on struggling day to day, but you do have options.

Cut The Expenses That Matter

Not cutting out your daily coffee, that won’t build that emergency fund faster, although directing some of this money there will help. It’s the big ticket expenses you’re paying for that you need to look at lowering — your utilities, insurance, and internet. All these costs are essential, but they can add up. And those who choose to switch can look at potentially saving hundreds of dollars over the year, with one study suggesting that investing in clean energy can cut costs by up to $500 per year.

Sell Things You Forgot You Owned

Get rifling through your cupboards and storage areas for items that are just collecting dust but could be worth something to others. That extra TV in the bedroom no one has used for over a year, the gym equipment you picked up at the new year, used once and forgot existed, or those clothes you bought and didn’t return because they didn’t fit right. Get a sorting a list of things for sale and use the money for things you actually need.

Start small with one room or one cupboard, and then aim for between 5 and 10 things you can sell. Then, once they’ve sold, move on to something else.

Rent Out Space You’re Not Using

This doesn’t automatically mean renting a spare room to a lodger unless you’re comfortable with that. But if you have other spaces others could use and you can charge for, then it’s worth looking into. A spare room with reliable internet could become an office for someone, a garage could become a storage space for others, or your driveway a parking space if you’re close to cities or areas with limited parking or that host events, i.e,. Football stadiums. Get creative with the free space you have and check out how you can use it to generate an income stream.

Sell The Property for Cash

If things are really tight and you genuinely cannot afford to continue living where you are, then selling your property for cash can open up options. When you need to sell my house fast, cash buyers purchase properties as is, and while you won’t get full or top market value, you will get a fair price, allowing you to explore other options such as downsizing, relocating to somewhere cheaper, or paying off debts and moving to rented accommodation. But it gives you viable options.

Use Home Equity

Not always an option for everyone, but if you’re sensible, you can unlock some of your home’s equity to help you out in the short term. Options such as refinancing or unlocking tiny amounts of equity release, if you qualify, can help you patch the hole in your finances and get back on track. Refinancing means you can pay off other debts and consolidate payments to reduce outgoings and build a savings pot or reinvest to boost property value. It’s worth exploring the positives and drawbacks of this option, as it’s not always the right choice.