For many, living a debt free life can feel like a goal that is way […]

Category: Budget

10 Essential Strategies to Optimize Your Budget and Enjoy Your Golden Years

Discover essential money-saving strategies for retirees! Explore tips on downsizing, relocating, healthcare savings, cooking at home, and more to stretch your retirement budget without sacrificing comfort.

DIY Home Décor Ideas on a Budget To Transform Your Space

Discover how to transform your living space without breaking the bank with our DIY Home Décor Ideas on a Budget. From easy tutorials to sourcing affordable materials and upcycling old items, unlock the secrets to creating a personalized sanctuary that reflects your style and personality.

Improve Your Personal Budget This Year

Looking to improve your finances? Start by reviewing your budget to ensure everything is accounted for. Boost your income through job changes or side gigs, and be specific about your expenses. Simplify your budget for better clarity and effectiveness. Discover tips to enhance your financial position today.

How To Make January Financially Easier

How To Make January Financially Easier January can be a tricky time financially if you’re […]

The Stress of Unpaid Debts: How to Handle the Anxiety and Take Control

The Stress of Unpaid Debts: How to Handle the Anxiety and Take Control. Grappling with […]

How the World is Set Up For Your Financial Success

How the World is Set Up For Your Financial Success. Of all the challenging aspects […]

Stop Struggling With Money: 3 Things to Try

Stop Struggling With Money: 3 Things to Try! Do you struggle to make ends meet? […]

Don’t Panic About Your Finances

Don’t Panic About Your Finances. Finding yourself in any kind of financial difficulty can be […]

Money Matters How To Make 2023 The Year Of Reduced Waste

Money Matters How To Make 2023 The Year Of Reduced Waste. The start of a […]

Ways to Act Now in Order to Save Later

Ways to Act Now in Order to Save Later. If you act now, you can […]

Proactive Ways to Beat the Cost of Living Crisis

The cost of living crisis has had a huge impact on us all, regardless of […]

How To Avoid Money Worries After An Injury

A serious injury can change your life in a big way, especially if you are […]

4 Ways To Boost Your Savings With Change

4 Ways To Boost Your Savings With Change. When you’re trying to save money, drawing […]

Money Management Made Easy: Our Tips

Money management gets very hard sometimes, and often enough we struggle to see a way […]

How To Prepare For Your Family’s Future

How To Prepare For Your Family’s Future. If you have just started a family, then […]

Smart Ways To Teach Children About Money

Being able to make good financial decisions doesn’t just happen. We have to teach our […]

Your Finances Don’t Have To Suffer From These Things

Your Finances Don’t Have To Suffer From These Things. It might not be something many […]

How You Can Get Through A Wonderful Holiday On A Budget

How You Can Get Through A Wonderful Holiday On A Budget When you think about […]

5 Effective Tips to Know What You are Worth in Assets

It’s important to know what you are worth. You can sleep soundly and make life […]

Saving Well for Later Life

There are plenty of things to think about when it comes to money management. Most […]

The Real Reasons You’re Always Broke

In our culture, nobody likes to apportion blame. But sometimes, the way our lives work […]

Budgeting Works, here is my tips and tricks!

I always get a new planning calendar at the first of the year. It doesn’t […]

Why You Almost Never Have To Pay Full Price Shopping Online

Going into a regular store and asking for a discount is something that people do, […]

Say Good Bye To Food Waste With These Easy-to Do Tips

Food waste is that it is rife in the Western world. The wasting of food […]

How to Help Your Elderly Parents Save Money

When your parents reach their senior years, your primary concern is likely to be their […]

Why Bankruptcy Should Always Be an Option if You’re Struggling With Your Finances

The word bankruptcy is scary to a lot of people. Most people see it as […]

Can You Cut Down Your Winter Budget?

Can You Cut Down Your Winter Budget? The days are getting shorter, the nights are […]

Protecting Your Money Even When You Are Gone

Protecting Your Money Even When You Are Gone. If you’ve been planning for the future, […]

Planning For The Future

Planning For The Future. The COVID-19 pandemic has got many of us thinking about the […]

Recuperating After Experiencing a Financial Disaster

Recuperating After Experiencing a Financial Disaster. Have you been facing financial disasters one after another? […]

5 Ideas To Earn Extra Money Online

5 Ideas To Earn Extra Money Online. Most of us wouldn’t mind a bit of […]

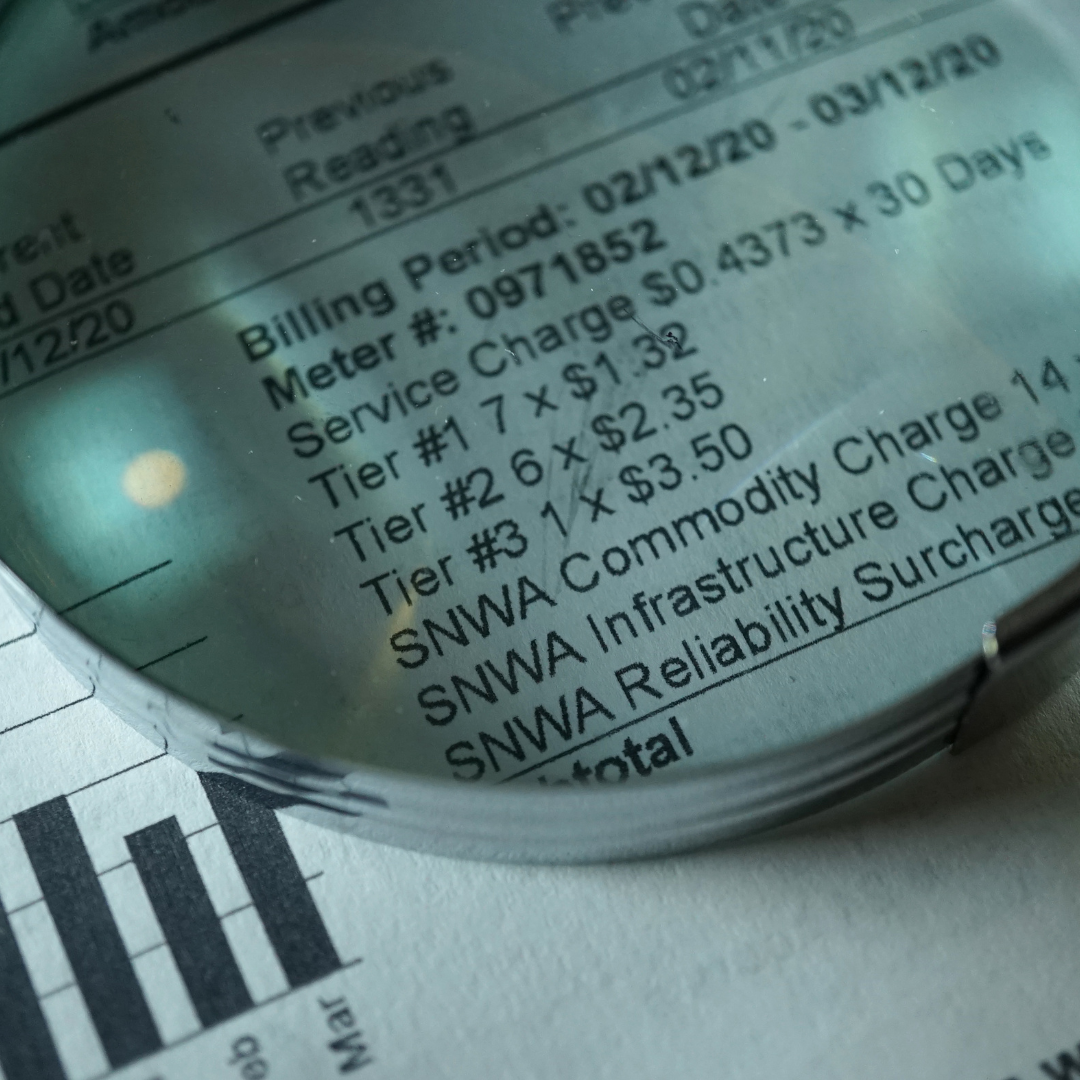

10 Ways To Lower Your Water Bills

Just been hit by an expensive water bill? While other utilities can often cost us […]

5 Questions to Ask About Disability Finance

5 Questions to Ask About Disability Finance Confused about disability finance? Worried about disability lawyers? […]

What You Need To Know Before Lending Right Now

What You Need To Know Before Lending Right Now. Are you in a jam and […]

Managing Life on a Smaller Budget

Managing Life on a Smaller Budget. It can be quite tough to raise a family […]

Foreign Exchange Trading Strategies That Work Even If You’re A Part-Timer

Foreign Exchange Trading Strategies That Work Even If You’re A Part-Timer. The price of one […]

What Are The Most Common Causes Of Money Problems?

What Are The Most Common Causes Of Money Problems? Money problems are one of the […]

Building Wealth vs. Making Money: What’s The Difference?

Building Wealth vs. Making Money: What’s The Difference? If you want to make sure you […]