The Stress of Unpaid Debts: How to Handle the Anxiety and Take Control.

Grappling with unsettled debts often feels like a relentless struggle, bringing along undue stress and worry. If you’re navigating this storm, remember you’re not isolated in this. Many are sailing in the same boat, and confronting this challenge directly is crucial for restoring financial stability and mitigating its emotional impact. In this article, we’ll delve into the pressures of unresolved debts, their effect on your existence, and actionable measures to tackle and eventually triumph over such hardships.

The Emotional Toll of Unpaid Debts

Anxiety and Sleepless Nights

- Unpaid debts can weigh heavily on your mind, causing sleepless nights and constant worry.

- Anxiety about bills and creditors’ calls can make it challenging to focus on other aspects of your life.

Strained Relationships

- Financial stress can strain relationships with loved ones, as the burden of unpaid debts affects not only you but also those around you.

- Communication breakdowns and arguments may become more common.

Negative Self-Image

- Unpaid debts can lead to feelings of shame and inadequacy.

- You might start to doubt your abilities and self-worth, which can further exacerbate stress and anxiety.

Understanding Your Debt Situation

Before you can tackle your unpaid debts effectively, it’s crucial to understand your financial situation fully. Here’s how you can gain clarity:

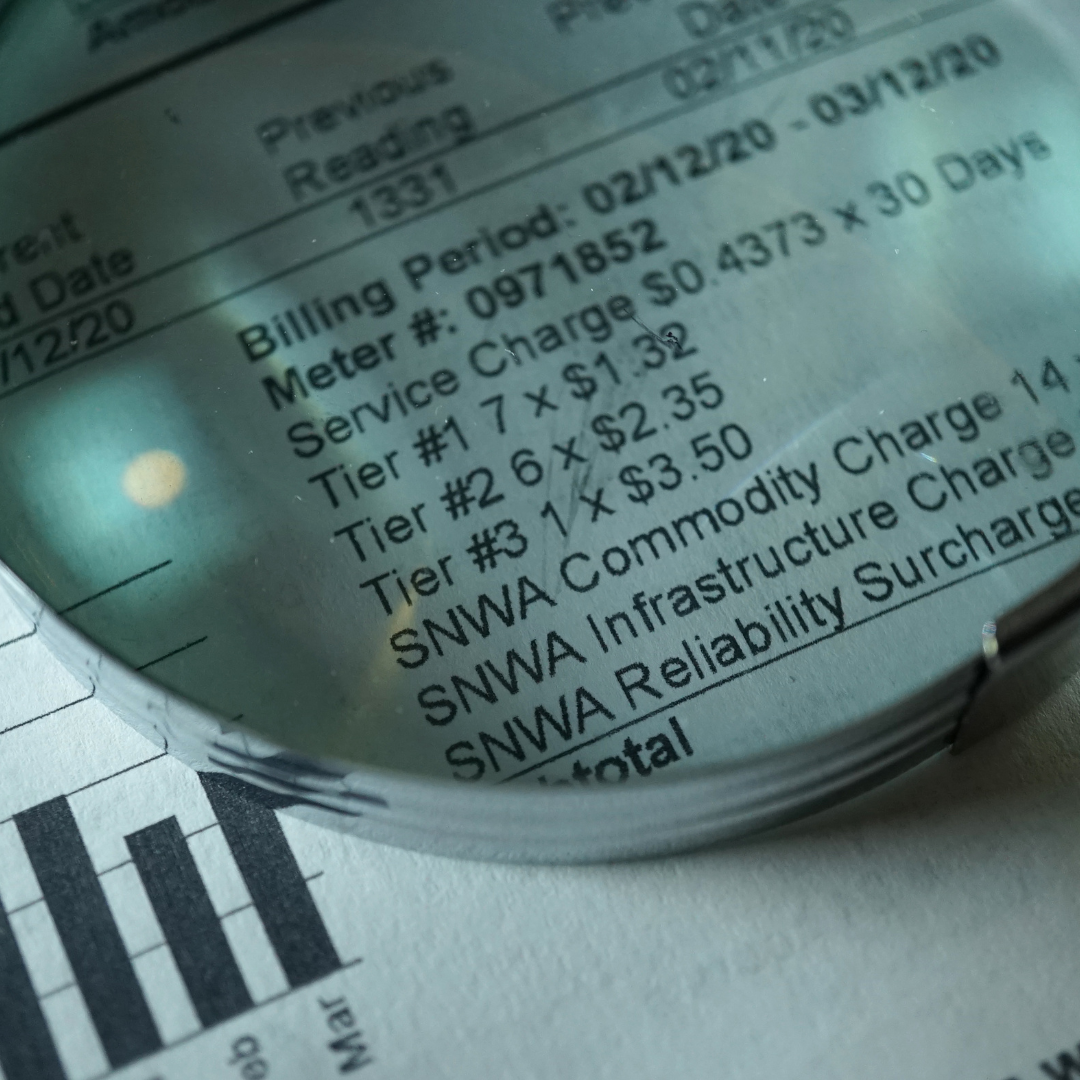

Create a List of Debts

- List all your debts, including credit card balances, loans, medical bills, and any other outstanding financial obligations.

- Note the creditor, outstanding balance, interest rate, and minimum monthly payment for each debt.

- See whether anyone actually owes you money. This is where leaning on professional debt tracers, like https://www.bondrees.com/tracing-debtors/, can help.

Assess Your Income and Expenses

- Calculate your monthly income from all sources.

- Track your monthly expenses, including necessities like housing, utilities, groceries, and discretionary spending.

Identify Your Debt-to-Income Ratio

- Calculate your debt-to-income ratio by dividing your total monthly debt payments by your monthly income.

- This ratio helps you understand the proportion of your income that goes toward debt repayment.

Managing Unpaid Debts

Prioritize Debts

Determine which debts are the most urgent by considering factors such as interest rates and payment terms.

Focus on paying off high-interest debts first to minimize the overall cost.

Create a Budget

- Develop a realistic monthly budget that accounts for your essential expenses, debt payments, and savings.

- Stick to your budget to ensure you have enough funds for debt repayment.

Negotiate with Creditors

- Don’t be afraid to contact your creditors to discuss your financial situation.

- They may be willing to offer temporary relief, such as lower interest rates or extended repayment terms.

Explore Debt Consolidation

- Debt consolidation involves taking out a new loan to pay off multiple debts.

- It can simplify your debt management and potentially lower your overall interest payments.

Consider Credit Counseling

- Non-profit credit counseling agencies can provide guidance on debt management and budgeting.

- They may also help you set up a debt management plan.

Avoid Taking on New Debt

- While working on paying off your existing debts, avoid accumulating more debt.

- Cut up or freeze your credit cards if necessary to prevent impulsive spending.

Moving Toward a Debt-Free Future

The journey to becoming debt-free is often a long one, but it’s entirely possible with dedication and a clear plan. Here are some steps to help you move closer to a debt-free future:

Stick to Your Budget

- Consistency is key. Stick to your budget and continue making timely payments on your debts.

- As you pay off one debt, allocate the freed-up money towards the next one.

Build an Emergency Fund

- Aim to save at least three to six months’ worth of living expenses in an emergency fund.

- Having this financial cushion can prevent you from relying on credit during unexpected situations.

Celebrate Milestones

- Celebrate your achievements along the way, whether it’s paying off a credit card or reaching a certain debt reduction goal.

- Acknowledging your progress can keep you motivated.

Stay Committed

- The path to debt freedom may have setbacks, but it’s essential to stay committed to your goal.

- Remind yourself of the financial freedom you’re working toward.

Explore Additional Income Streams

- Look for opportunities to increase your income, such as taking on a part-time job, freelancing, or selling unused items.

- The extra income can accelerate your debt repayment.

Conclusion

Owing money can indeed amplify anxiety and stress levels, but it shouldn’t dictate your life. By being forward-thinking, grasping your financial stance, and adopting feasible plans, you can reclaim your hold and inch towards a debt-free horizon. Keep in mind, that it’s not solely about financial juggling; it’s equally pivotal to nurture your mental wellness. Through grit and the right guidance, you can transcend the pressures of outstanding debts and set the stage for a flourishing financial path ahead.